Financial strategy

Our financial strategy helps guide decisions on budgeting, investment, and revenue generation to help ensure funds are used wisely, services are maintained or improved, and that we have a plan for managing any challenges.

| Borrowing limits |

Policy maximum |

Forecast level at 30 June 2025 |

Forecast maximum at 10 years |

Forecast level at 30 June 2034 |

| Net external debt as a percentage of total assets |

20% |

12.5% |

18.2% |

13.3% |

| Net external debt as a percentage of total revenue |

250% |

169.8% |

243.6% |

205.6% |

| Net interest as a percentage of total revenue |

15% |

8.2% |

12.5% |

10.8% |

| Net interest as a percentage of annual rates income |

20% |

10.8% |

15.5% |

13.0% |

| Liquidity |

110% |

114% |

110% |

110% |

Read our draft strategy

Financial strategy 2024-34 (draft)(PDF, 551KB)

You can find more financial information on our supporting information page.

The key points of our financial strategy

Our Nature Calls wastewater project poses the largest financial challenge to Council. We do not have the financial capacity to borrow to fund this from our normal funding sources. In our draft plan we have assumed we will be able to use the IFF fund for this project. You can read more about this on the Nature Calls page.

We have assumed Council will be responsible for providing the water activities throughout the 10 years of our long-term plan. Even though we’ve assumed that we’re responsible for delivering water, we’ve had to make some hard calls and cut the level of capital spend in the water budgets from Year 4 onwards – to help with the affordability of our plan. .

Over the next decade we will be spending $2.3billion dollars on capital projects. That is made up of $1.559B on Capital New, $296M on Capital Growth and $442M on Capital Renewal.

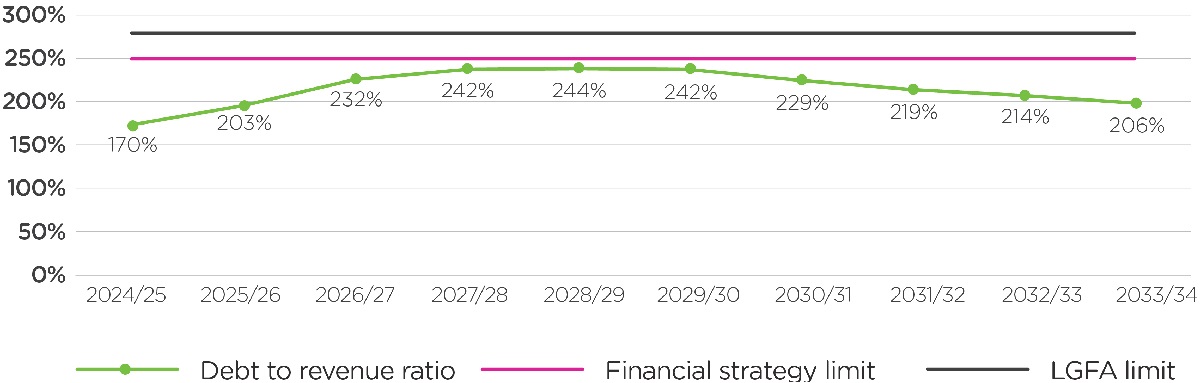

Debt to revenue ratio

Due to scale of the capital projects proposed, we’ll need to borrow more than our current borrowing limits would allow. As a result we have decided to increase Council’s maximum debt limit (measured by the net debt to revenue ratio) from 200% to 250%. This ratio is still considered to be prudent and is less than the maximum of 280% available through Council’s key borrowing source – the NZ Local Government Funding Agency.

To help ensure we are able to remain within the updated debt limit, it is planned to accelerate the debt repayment between Year 4 and Year 10 of the plan. This equates to $149M in additional repayments.

Our latest assessment shows that to protect our infrastructure assets we need to significantly increase the amount we spend on replacing and renewing them. This draft Long-Term Plan provides for a progressive increase in this renewal spending.

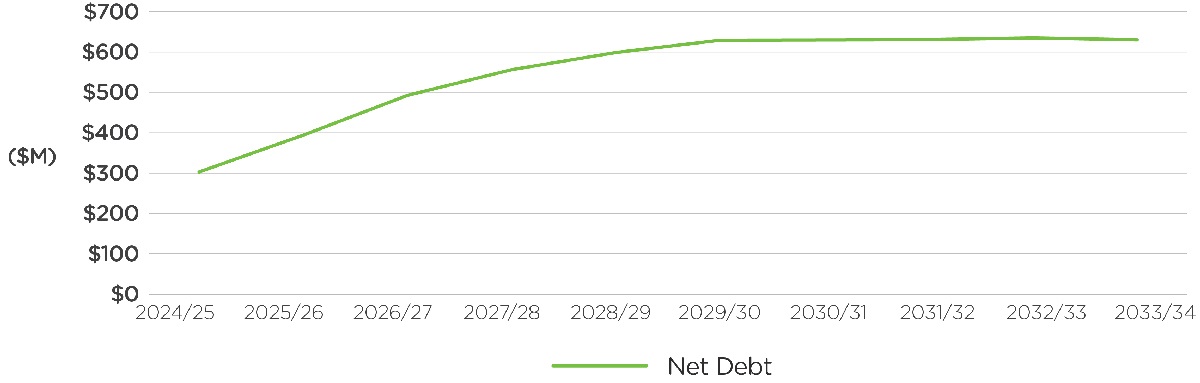

Net debt forecast

We will look at our land and assets and consider whether they could be used differently to reduce costs.

We’ve assumed that many of our projects will need to be funded from more than just debt. We already get some funding from the NZ Transport Agency – Waka Kotahi as well as other external grants to help with projects. We’re hoping to add to this with tools like the IFF and Public Private Partnerships (leasing properties rather than owning them). Some projects we’ve tagged for external funding include some growth programmes, Te Motu o Poutoa Anzac Park and seismic upgrades to our Central Library and Te Manawa.

Every project would be looked at separately to determine the co-funding we need. If we can’t find the best solution for our ratepayers, we’ll have to rescope, stop or reprioritise this work ahead of other projects.

Like other cities in New Zealand, our proposed rates increases throughout the term of the plan are higher than previously assumed would be necessary. If we end up using the IFF for Nature Calls, our ratepayers will have a large levy in addition to their rates from around Year 4. If we use a similar tool for growth programmes, this could also impact some ratepayers.